- Proposed dividend of EUR 1.05 per share (2015: EUR 0.85 per share) marks an increase of 23.5%

- Revenues up 7.2% in financial year 2016 to EUR 1,375.5m

- Revenues at constant exchange rates EUR 1,383.1m with 2.9% organic revenue growth

- Adjusted EBITDA climbs to EUR 307.8m; at constant exchange rates to EUR 311.3m

- Adjusted EBITDA margin rises by 1.9 percentage points to 22.4%

- Adjusted earnings per share after non-controlling interests increased from EUR 3.41 to EUR 4.22

- Focus on core business: sale of the Life Science Research Division completed as of October 31, 2016

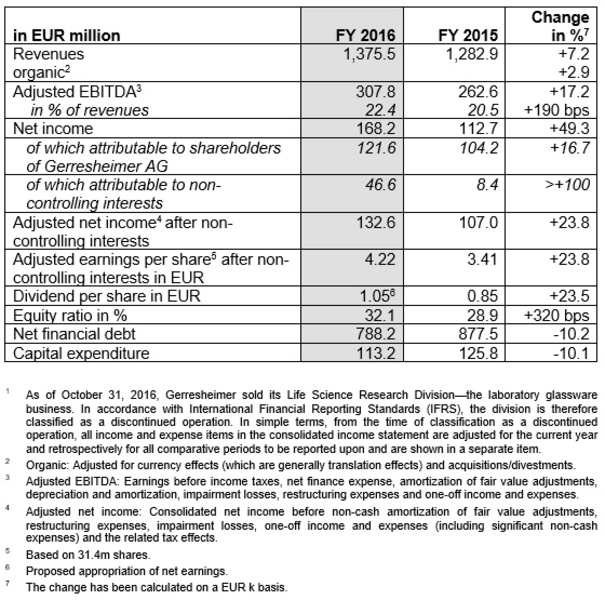

Duesseldorf, February 15, 2017—Gerresheimer AG brought financial year 2016 to a successful close and sees strong growth prospects for the years ahead. Gerresheimer is one of the leading partners to the pharma and healthcare industry worldwide and manufactures glass and plastic pharma and cosmetics packaging. “2016 was a successful year for us. We delivered on our guidance for all key performance indicators and have grown substantially. Moreover, we further sharpened our focus on our core business. Going forward, we will continuously expand our development capabilities and product portfolio for the biotech and specialty pharma industry. In addition, we aim to further increase our profitability. The Company is ready for the challenges in the next years ahead,” said Uwe Röhrhoff, CEO of Gerresheimer AG.

As of October 31, 2016, Gerresheimer sold its Life Science Research Division—the laboratory glassware business. In accordance with International Financial Reporting Standards (IFRS), the division is therefore classified as a discontinued operation. In simple terms, from the time of classification as a discontinued operation, all income and expense items in the consolidated income statement are adjusted for the current year and retrospectively for all comparative periods to be reported upon and are shown in a separate item.

Gerresheimer increased revenues in financial year 2016 (December 1, 2015 to November 30, 2016) by 7.2% to EUR 1,375.5m. On an organic basis, revenues went up by 2.9% to EUR 1,383.1m, within the target range of EUR 1,400m plus or minus EUR 25m. Notable revenue growth was generated with inhalers, plastic pharma packaging, injection vials and cosmetic glass.

Adjusted EBITDA climbed in financial year 2016 to EUR 307.8m and at constant exchange rates to EUR 311.3m—at the upper end of the guidance range of EUR 305m plus or minus EUR 10m. The adjusted EBITDA margin was for the first time above the 22% mark, at 22.4% compared with a prior-year figure of 20.5%. Net income increased by 49.3% to EUR 168.2m, notably due to the sale of the Life Science Research Division. Adjusted earnings per share after non-controlling interests rose from EUR 3.41 to EUR 4.22.

At 15.8% excluding the Life Science Research Division, average net working capital as a percentage of revenues likewise exceeded the Company’s expectations. Net financial debt was scaled back by EUR 89.3m to EUR 788.2m, mainly due to the proceeds from the sale of the Life Science Research Division. Leverage, the ratio of net financial debt to adjusted EBITDA, was reduced from 2.9 to 2.6.

Gerresheimer’s capital expenditure in financial year 2016, at EUR 113.2m compared with EUR 125.8m in the prior year, corresponded to 8.2% of revenues at constant exchange rates excluding the Life Science Research Division. The Company continued to invest in standardizing and modernizing the machinery park in the glass segment. It also modernized the German cosmetic glass plant in Tettau and further expanded decorating capacity. Expansion continued at the Peachtree City plant in the USA, which produces medical plastic systems such as asthma inhalers.

“We are optimistic for the future and continue to invest in key growth markets, even though the beginning of financial year 2016/17 appears to be more difficult than the start of the prior year. Our dividend proposal, representing a 23.5% increase to EUR 1.05 per share, reflects the significant improvement in our financial performance indicators,” Uwe Röhrhoff added.

Outlook

Gerresheimer’s expectations for financial year 2017 are set out in the following, in each case based on constant exchange rates. For the US dollar—which is expected to have the largest currency impact on the Group currency, accounting for about a third of Group revenues in 2017—Gerresheimer has assumed an exchange rate of approximately USD 1.10 to EUR 1.00.

In financial year 2017, Gerresheimer anticipates Group revenues of around EUR 1.43bn (plus or minus EUR 25m) on a constant exchange rate basis, compared with EUR 1,375.5m in 2016. Adjusted EBITDA is expected to increase from EUR 308m in 2016 to some EUR 320m (plus or minus EUR 10m) in financial year 2017. Based on the improvement in adjusted EBITDA, adjusted earnings per share after non-controlling interests—the basis of Gerresheimer AG’s dividend policy—is projected to rise to a figure in the range EUR 4.20 per share to EUR 4.55 per share (2016 adjusted for the discontinued operation comprising the Life Science Research Division: EUR 4.07 per share).

Largely due to the favorable growth prospects and as a result of the initiatives to boost productivity and quality, capital expenditure in the financial year 2017 is expected to amount to around 8% of revenues at constant exchange rates.

The Company’s expectations through to the end of 2018 are as follows:

- Gerresheimer aims for average organic revenue growth of 4% to 5%.

- For the adjusted EBITDA margin, the Group’s target is some 23% for financial year 2018. The Company is thus raising the previous guidance of above 22% for this ratio.

- In order to meet these targets, Gerresheimer will, in all probability, require annual capital expenditure of the order of about 8% of revenues at constant exchange rates.

- Alongside the operating measures, the Group’s net working capital profile has also significantly improved, among other things as a result of the sale of the glass tubing business and the Life Science Research Division together with the acquisition of Centor. For the future, the Company therefore anticipates that average net working capital as a percentage of revenues will be approximately 16% (previously approximately 17%).

- Gerresheimer expects that its operating cash flow margin will be around 13%, as before.

The Group’s long-term target remains:

- As before, attainment of at least 12% ROCE.

- Gerresheimer believes a net financial debt to adjusted EBITDA ratio of 2.5 to be right for Gerresheimer, with temporary variation above or below this tolerated because expedient M&A activity cannot be planned in detail.

Dividend

At the Annual General Meeting on April 26, 2017, the Management Board and Supervisory Board will be jointly proposing that a dividend of EUR 1.05 per share be paid out for financial year 2016. This represents an increase of 23.5% against the prior-year dividend. The dividend ratio amounts to 24.9% of adjusted net income after non-controlling interests.

The Annual Report is available here: Reports

About Gerresheimer

Gerresheimer is a leading global partner to the pharma and healthcare industries. The company’s special glass and plastic products contribute to health and well-being. Gerresheimer is a global organization with about 10.000 employees and manufacturing operations in the local markets, close to customers. With plants in Europe, North and South America and Asia Gerresheimer generates revenues of approximately EUR 1.4 billion. The comprehensive product portfolio includes pharmaceutical packaging products as well as convenient and safe drug delivery systems such as insulin pens, inhalers, pre-fillable syringes, vials, ampoules, bottles and containers for liquid and solid pharmaceuticals with closure and safety systems, plus cosmetic packaging products.