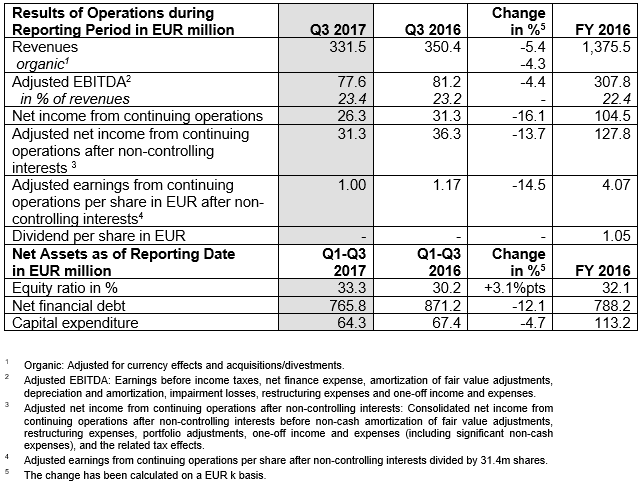

- Revenues down from EUR 350.4m in Q3 2016 to EUR 331.5m in Q3 2017; organic decrease of 4.3%. Adjusted EBITDA margin slightly improved to 23.4% (Q3 2016: 23.2%)

- EBITDA leverage, at 2.6, back at same level as of November 30, 2016 and thus significantly better than expected

- Successful launch of EUR 250.0m promissory loan

- Outlook: Company expects good Q4 2017. Nonetheless there are signs of revenue risks of the order of EUR 30m relative to the last guidance of EUR 1.4bn for the financial year 2017, with negative impacts on adjusted EBITDA and adjusted earnings per share

Duesseldorf, October 11, 2017—After a moderate nine months, Gerresheimer AG expects a recovery in revenues in the fourth quarter. Despite the fall in revenues in the third quarter 2017, the strict cost management enabled the company to slightly improve the adjusted EBITDA margin to 23.4%.

In the third quarter of the financial year 2017 (June 1, 2017 to August 31, 2017), Gerresheimer generated revenues of EUR 331.5m, 5.4% less than the EUR 350.4m recorded in the prior-year quarter. On an organic basis—meaning at constant exchange rates and adjusted for acquisitions and divestments—revenues decreased by 4.3%. The third quarter saw a continuation of the lower demand for medical plastic systems from a number of pharma customers where Gerresheimer is the sole supplier. This effect was compounded by a decline in demand in the inhalation business, which is expected to be only partly offset in the fourth quarter of 2017 by a new inhaler project in Peachtree City, USA. As expected, revenues in the engineering and tooling business were lower in the third quarter of 2017 than in the prior-year quarter. Temporary intra-year fluctuations are normal and depend on the billing of large-scale customer projects. Here the Company expects a substantial increase in the fourth quarter of 2017. Sales of plastic packaging for solid and liquid drugs were slightly higher in the third quarter than in the prior-year quarter. Third-quarter revenues with glass primary packaging were down on the prior-year period, mainly due to lower revenues in North America. Outside of North America, revenues with glass primary packaging virtually matched the prior year.

Adjusted EBITDA decreased from EUR 81.2m in the third quarter of 2016 to EUR 77.6m. At constant exchange rates, adjusted EBITDA was EUR 79.0m. Strict cost control and ongoing focus on operational efficiency enabled a slight improvement in the adjusted EBITDA margin to 23.4% in the third quarter of 2017. Gerresheimer reported net income from continuing operations of EUR 26.3m in the third quarter, compared with EUR 31.3m in the prior year. Adjusted net income from continuing operations was EUR 32.1m in the third quarter of 2017, compared with EUR 37.0m in the prior-year quarter. Adjusted earnings from continuing operations per share after non-controlling interests consequently came to EUR 1.00 in the third quarter of 2017, as against EUR 1.17 in the prior-year quarter.

Adjusted EBITDA leverage (the ratio of net financial debt to adjusted EBITDA) was 2.6 as of August 31, 2017, back at the same level as at the financial year-end 2016 and thus better than expected.

On September 27, 2017—subsequent to the third-quarter reporting date—Gerresheimer successfully launched a EUR 250m promissory loan. The promissory loan features predominantly fixed coupon rates of 0.82%, 1.25% and 1.72% with five, seven and ten-year maturities respectively. This means that funding for the EUR 300m bond issue maturing on May 19, 2018 is already secured.

Gerresheimer incurred EUR 28.9m in capital expenditure in the third quarter of 2017, compared with EUR 32.4m in the prior-year quarter. Capital expenditure mainly related to the acquisition of an exclusive license for an integrated, passive syringe safety system and additions to production capacity for plastic packaging in the USA. In glass primary packaging, investments were primary on molds, tools and modernization.

Outlook

Gerresheimer’s expectations for financial year 2017, in each case at constant exchange rates and excluding acquisitions or divestments, are as follows: For the US dollar—which is expected to have the largest currency impact on the Group currency, accounting for about a third of Group revenues in 2017—Gerresheimer has assumed an exchange rate of approximately USD 1.10 per EUR 1.00.

Gerresheimer expects a good fourth quarter 2017. From today’s perspective, however, its guidance for Group revenues at constant exchange rates of approximately EUR 1.4bn for the financial year 2017 is nonetheless fairly hard to attain. According to internal estimates, there is a revenue risk of approximately EUR 30m. Should that EUR 30m revenue risk materialize—which appears to be more likely than not at present—the Group’s adjusted EBITDA may be about EUR 10m lower than its expectation of approximately EUR 320m. As a result, adjusted earnings from continuing operations per share after non-controlling interests may be approximately EUR 0.17 below the expected figure of around EUR 4.25. This must also be viewed in light of the EUR 48m shortfall at constant exchange rates relative to the prior year that Gerresheimer has already accumulated up to the end of the third quarter of 2017. Overall, delivering all orders accepted for the fourth quarter of 2017 already presents a major challenge today. This effect is compounded among other things by extraneous factors such as the dynamic of pharma customers in the aggregate, and notably in relation to the US market, or supply chain interruptions, all of which could possibly amplify the revenue risks described. The Company still anticipates that capital expenditure in the financial year 2017 will amount to around 8% of revenues at constant exchange rates.

In principle, the Company continues to adhere to its guidance for 2018, based on revenues as of the year-end 2017.

The quarterly report is available here: Reports

About Gerresheimer

Gerresheimer is a leading global partner to the pharma and healthcare industries. The company’s special glass and plastic products contribute to health and well-being. Gerresheimer is a global organization with about 10,000 employees and manufacturing operations in the local markets, close to customers. With plants in Europe, North and South America and Asia Gerresheimer generates revenues of approximately EUR 1.4 billion. The comprehensive product portfolio includes pharmaceutical packaging products as well as convenient and safe drug delivery systems such as insulin pens, inhalers, pre-fillable syringes, vials, ampoules, bottles and containers for liquid and solid pharmaceuticals with closure and safety systems, plus cosmetic packaging products.