“We have successfully signed additional contracts with attractive terms for GLP-1 platforms,” says Dietmar Siemssen, CEO of Gerresheimer AG. “We will finance corresponding capacity expansions with the funds from the capital increase. The new orders give us tailwind for our profitable growth in subsequent years and underpin our solution expertise in biopharmaceuticals with complex requirements. Overall, we are seeing the highest order intake in the history of our company at the moment.”

Against the backdrop of long-term customer contracts that have already been concluded, Gerresheimer is currently expanding production capacities in Europe, the U.S., and Mexico for drug delivery systems such as syringes, auto-injectors, and pens, as well as containment solutions such as injection vials and primary packaging made of plastic.

Plastics & Devices: containment solutions and pens drive growth

The Plastics & Devices Division generated revenues of EUR 754.8m in the first nine months of the financial year 2023 (9M 2022: EUR 657.9m). Organic revenue growth (without exchange rate effects) stood at 14.7%. The high demand for containment solutions and drug delivery systems such as inhalers and pens contributed to the positive development.

Adjusted EBITDA saw a strong organic increase of 19.9% year on year in the first nine months of the financial year. Thanks to the improved product mix, the adjusted EBITDA margin improved by 0.8 percentage points to 23.8%.

Primary Packaging Glass: strong demand for high-value cosmetics

In the first nine months of the financial year 2023, revenues in the Primary Packaging Glass Division reached EUR 689.7m (9M 2022: EUR 628.4m). Organic revenue growth stood at 10.5%. The strong demand for high-value cosmetics solutions made up for the temporary decline in demand for injection vials following the Covid-19 pandemic.

In the Primary Packaging Glass Division, the improved product mix had a significantly positive impact on adjusted EBITDA and the margin, with adjusted EBITDA growing organically by 23.2% and the adjusted EBITDA margin improving by 1.6 percentage points to 20.2%.

Outlook confirmed

Gerresheimer expects the positive business performance to continue in the final quarter of the financial year 2023 and confirms its guidance for the full year.

Guidance for FY 2023 (for group level, currency-adjusted):

- Organic revenue growth: at least 10%

- Organic adjusted EBITDA growth: at least 10%

- Adjusted EPS growth: low single-digit percentage

Medium-term guidance (for group level, currency-adjusted):

- Organic revenue growth: at least 10%

- Organic adjusted EBITDA margin: 23 – 25%

- Adjusted EPS growth: at least 10% a year

The Quarterly Statement is available on the Gerresheimer website here:

https://www.gerresheimer.com/en/company/investor-relations/reports

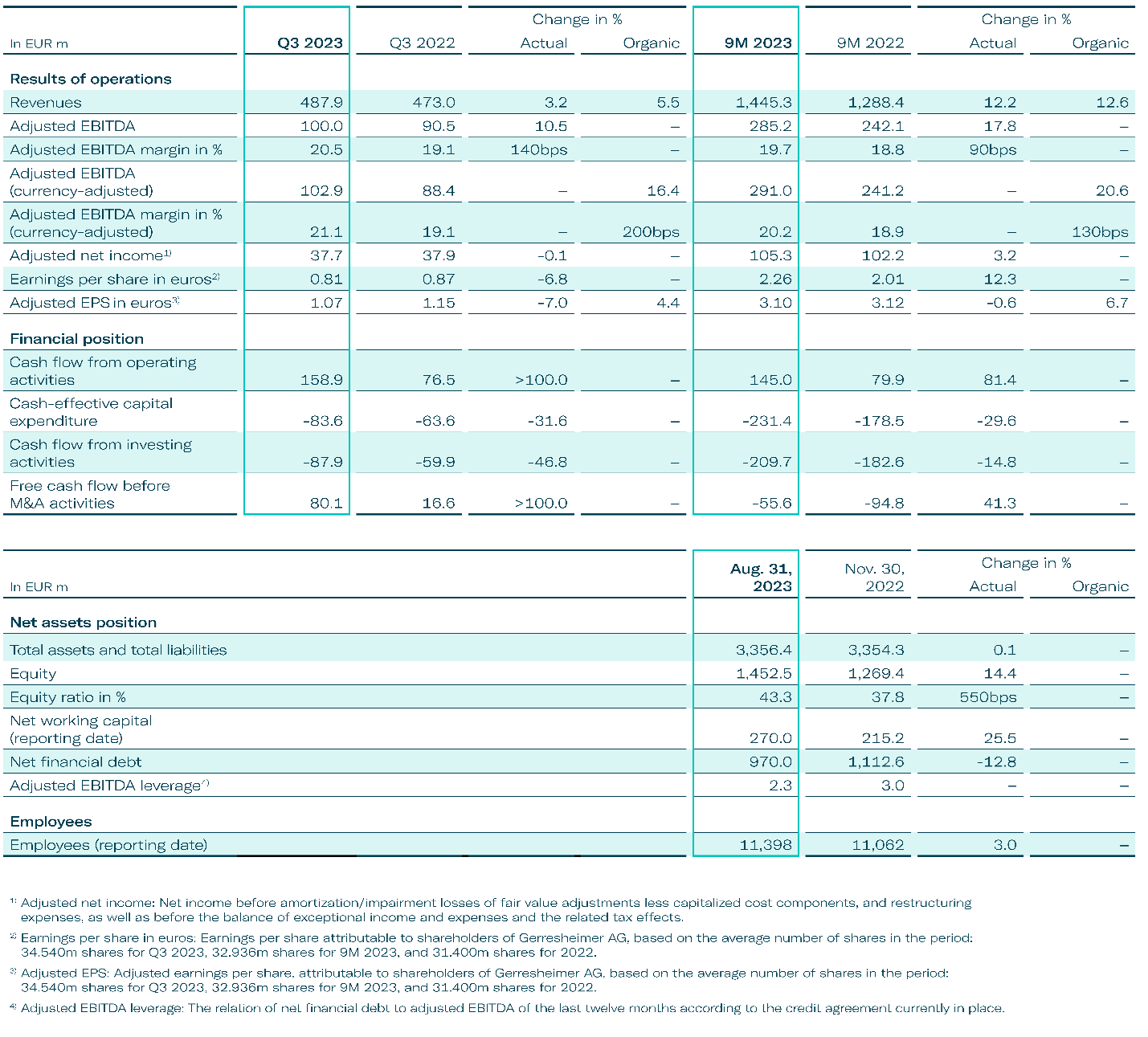

Key Figures Gerresheimer (group)