- Foundation for sustainable and profitable growth laid in 2019: Annual revenue growth in the mid-single-digit percentage range targeted for 2020 and subsequent years

- 2019 operating targets met: Underlying revenues reach EUR 1.40bn and underlying adjusted EBITDA EUR 293m

- Further increase in proposed dividend to EUR 1.20 per share from EUR 1.15 in the prior year

Duesseldorf, February 19, 2020—Gerresheimer AG brought the financial year 2019 to a successful close. “Together, in 2019 we laid the foundation to make Gerresheimer fit for the future and setting the Company firmly on the path to growth. We actively addressed the themes of innovation, excellence and sharpening our customer and employee focus and will continue to do so. We invested record sums in growth, capacities, process optimization and digitalization. Our clear goal: Sustainable and profitable growth,” says Dietmar Siemssen, CEO of Gerresheimer AG.

In 2019, Gerresheimer set the course for profitable growth. For future growth, the Company is focusing on new segments such as full solutions for biotech drugs, as well as innovation, generating higher revenues in fast-growing markets and capital expenditure. The biggest Capex program in Gerresheimer’s corporate history was launched in 2019, paving the way for growth. Specifically, capital expenditure in 2019 amounted to EUR 185m and centered on growth projects, building up capacity, process optimization and digitalization. This included the continued expansion of inhaler production at the Horsovsky Tyn plant in the Czech Republic, construction of the new plants in North Macedonia and Brazil as well as expanding the product portfolio and production capacity. Two new plants for the production of plastic primary pharmaceutical packaging also opened in China and India. Other capital expenditure related to the scheduled furnace overhaul and expansion in Essen, Germany, as well as production plant modernization and automation at various sites. In addition, the new glass innovation and technology center in North America was launched as part of a customer event.

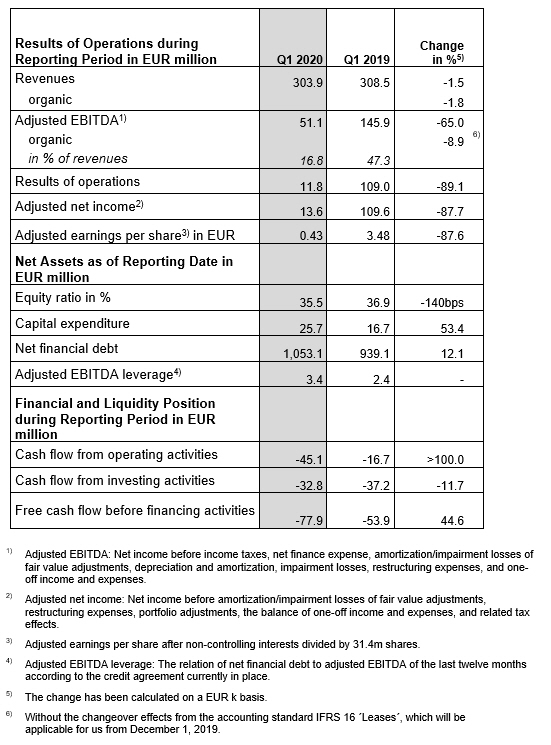

Gerresheimer increased underlying revenues at constant exchange rates by 2.4% from EUR 1,365.5m to EUR 1,397.5m in the financial year 2019. Excluding the one-off effects from the unexpected cancellation of the project to develop a micro pump for the treatment of diabetes, revenues at constant exchange rates rose by 0.5% from EUR 1,373.5m to EUR 1,380.2m.

The syringe business performed very well in the financial year 2019. Revenues from plastic primary pharmaceutical packaging also grew, particularly in South America and Asia. Revenues from primary packaging glass showed healthy growth, notably driven by the strong demand for high-quality cosmetics packaging. In the cosmetics packaging business, the Company is increasingly targeting sustainable solutions, primarily through the use of recycled glass and plastic. In Europe and Asia, revenues from injection vials, ampoules and cartridges rose significantly. By contrast, revenues from these products declined slightly in North America due to lower demand from a major customer. In the Advanced Technologies Division, the micro pump for the treatment of Parkinson was successfully launched in the market. A new project for using the micro pump for the treatment of heart diseases was secured and is currently under way. Further potential uses of the micro pump in different therapeutic areas are now being examined with customers.

Adjusted operating EBITDA at constant exchange rates was EUR 292.8m in the financial year 2019, up 0.7% on the prior-year figure of EUR 290.6m. Adjusted EBITDA at constant exchange rates, excluding the extraordinary effects from the unexpected cancellation of the project to develop a micro pump for the treatment of diabetes, amounted to EUR 396.1m in the financial year 2019, as against EUR 300.2m in the prior year.

The unexpected cancellation of the diabetes project was due to a change of strategy at Sanofi. This resulted in the following non-cash extraordinary effects:

The cancellation of this project led to a contract modification and thus to a cumulative adjustment of the revenues recognized up to this point in the amount of EUR 17.3m. This had a corresponding negative impact on adjusted EBITDA at constant exchange rates which was also impacted by EUR 9.2m in this connection. In addition, impairment losses totaling EUR 116.7m were recorded in the financial year 2019. This was offset by other operating income of EUR 129.8m due to the derecognition of contingent purchase price components relating to the acquisition of Sensile Medical.

Net financial debt increased year on year and amounted to EUR 942.7m as of November 30, 2019, compared to EUR 886.4m as of the prior-year reporting date. Adjusted EBITDA leverage (net financial debt to adjusted EBITDA over the last twelve months, according to the credit line agreement in force) amounted to 2.4x as of November 30, 2019.

The Management Board and the Supervisory Board will propose to the Annual General Meeting on June 24, 2020 to distribute a dividend of EUR 1.20 per share for the financial year 2019. In the prior year, the dividend was EUR 1.15 per share.

Guidance for 2020

For the financial year 2020, Gerresheimer forecasts:

- Revenue growth in the mid-single-digit percentage range

- Adjusted EBITDA margin of around 21%

- Capital expenditure amounting to approximately 12% of revenue

Indications for subsequent years

- Annual organic revenue growth in the mid single-digit percentage range

- Targeted medium-term adjusted EBITDA margin of 23%

- Annual capital expenditure of between 8% and 10% of revenues

The Annual Report 2019 is available here:

www.gerresheimer.com/en/investor-relations/reports

About Gerresheimer

Gerresheimer is a leading global partner to the pharma and healthcare industry. With specialty glass and plastic products, the Company contributes to health and well-being. Gerresheimer has worldwide operations and around 10,000 employees manufacture products in local markets close to its customers. With plants in Europe, North America, South America and Asia, Gerresheimer generates revenues of approximately EUR 1.4bn. Its comprehensive product portfolio includes pharmaceutical packaging and products for safe and simple drug delivery: insulin pens, inhalers, micro pumps, prefillable syringes, injection vials, ampoules, bottles and containers for liquid and solid medicines with closure and safety systems, as well as packaging for the cosmetics industry.